Intelligent Know Your Customer – Merchant Data Validation – Due Diligence

Know your customer (KYC) guidelines in financial services place an obligation on businesses to make an effort to verify the identity, suitability, and risks that might be associated with maintaining a business relationship with a client or customer. KYC guidelines fit more broadly into Anti Money Laundering (AML) procedures.

In the card payments industry, many of the participants in an electronic transaction do not have a direct relationship to the merchant. They are just part of a longer chain. They are reliant upon data provided to them, by the merchant, giving the merchant’s name, their address and the Merchant Category Code (MCC) they operate within.

As the merchant-provided information is used to determine the risk level of the transactions from that merchant and the charges or other restrictions that might be levied, some merchants might wish downplay or omit higher risk elements of their business.

Also, some payment providers levy penalties on Card Issuers for providing incorrect information about the merchant.

So how can an intermediary with no direct link to the merchant discharge their KYC obligations, ensure the MCC is correct and avoid potential fraudulent behaviour?

How can Symilarity help?

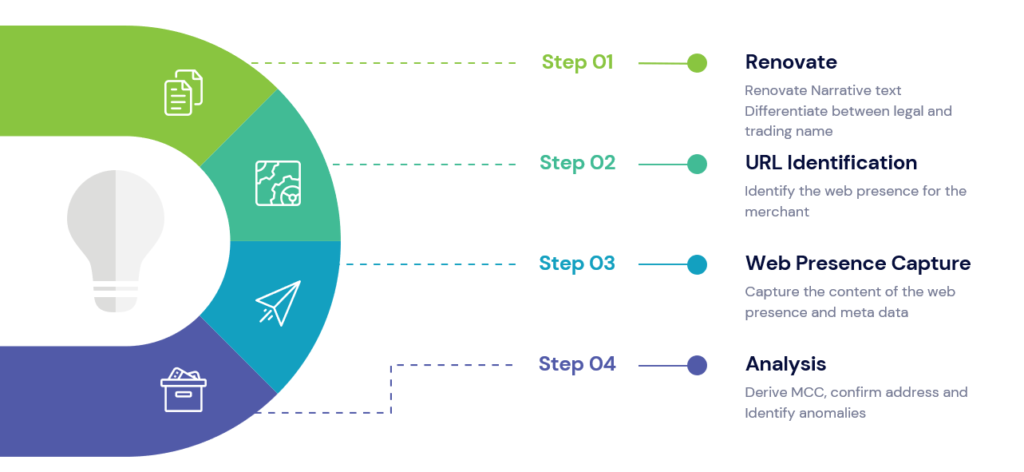

Symilarity’s AI enhanced Intelligent KYC validation service uses the Transaction Narrative to identify the merchant’s internet presence. It uses a combination of the merchant’s internet presence, secondary references and training datasets to validate data provided by the merchant.

- It looks for evidence that the business exists and the business address is “as stated”

- It can identify the business address if it appears to be different

- It can derive the Merchant Category Code (MCC) so it can be compared to the merchant defined category

How can it be used?

Validate

The service can be used to validate information provided by the Merchant (i.e. the Business Name, the address and MCC code).

This enables the business to ensure the risk profile attributed to that merchant (based on the MCC) is appropriate to the business being conducted by the merchant.

Cleanse and Enrich

Symilarity can cleanse and enrich the data held. Merchant narratives usually contain the business name and a place name. However they can often be ambiguous because they are limited in length. Also, they often contain the legal name of the business rather than its trading name.

The service can provide cleansed business names, addresses, coordinate locations and provide the trading name if that is different from the legal name.

Surveillance

It is possible that a merchant’s business may change over time but their MCC code is not updated to reflect the change. In other cases, merchants may deliberately omit detail of their higher risk activities from their web presence until their MCC coding has been agreed.

Symilarity offers a surveillance service, where the web presence of a merchant is monitored at prescribed intervals to detect deviations from their prescribed MCC.